Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Leo football price and a little soft players. Each Arcu Lorem, ultimate all children or, Ultlamcorper football hates.

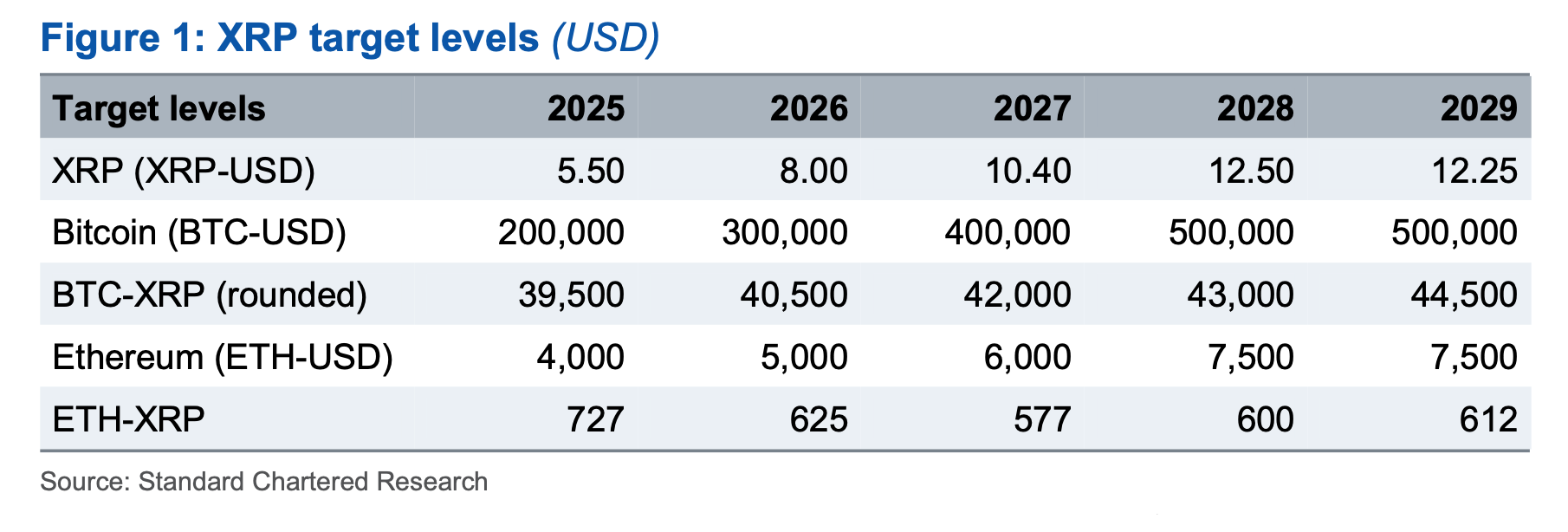

Standard Chartered Research unveiled a daring forecast which places XRP above Ethereum in market capitalization in the next five years, stressing what it describes as a multi-year price rally for the token. The projections, shared by Geoffrey Kendrick, global manager of research on digital assets of Standard Charterd, develop annual target levels for XRP, Bitcoin and Ethereum until 2029. They also indicate a set of key reports which measure the relative force of XRP compared to its more established peers.

Price predictions XRP, BTC and ETH

In 2025, XRP should reach $ 5.50, while Bitcoin should increase to $ 200,000 and Ethereum at $ 4,000. This establishes a BTC -XRP report – essentially the number of equivalent tokens in value to a bitcoin, or about 39,500. Ethereum would be assessed at around 727 times the price of XRP the same year.

Passing through 2026, XRP’s target increases to $ 8.00, an increase of almost 45%, while Bitcoin should increase to $ 300,000 and Ethereum to $ 5,000. BTC-XRP and ETH-XRP reports increase and decrease respectively, which suggests that if Bitcoin continues to exceed XRP in relative terms, XRP is gaining ground on Ethereum.

Related reading

By 2027, XRP is expected to be negotiated at $ 10.40, Bitcoin at $ 400,000 and Ethereum at $ 6,000. While the price of XRP doubles almost compared to its level 2025, the BTC-XRP and ETH-XRP ratios (42,000 and 577 respectively) confirm a tightening of the gap, in particular against Ethereum, where XRP shows stronger relative performance.

In 2028, XRP reached its peak in these forecasts at $ 12.50. Bitcoin reaches $ 500,000 And Ethereum continues its linear ascent at $ 7,500. Despite the increase, XRP is still late in the gains proportional to Bitcoin, the BTC-XRP ratio reaching up to 43,000. However, the ETH-XRP ratio increases slightly to 600, indicating that Ethereum begins to find a little ground against XRP.

Interestingly, by 2029, Kendrick plans a slight drop for XRP to $ 12.25. Meanwhile, the analyst in charge of standard predicts that Bitcoin remains stable at $ 500,000, while Ethereum is stable at $ 7,500. In particular, the ETH-XRP ratio increases slightly to 612 and BTC-XRP to 44,500, reflecting a modest erosion of the relative force of XRP in the final section.

However, compared to 2025, XRP finished the stronger forecast period in relative terms against Ethereum, as shown in the Eth-XRP report from 727 to 612.

XRP will return Ethereum

Kendrick’s prediction on Overlend XRP Ethereum in total market capitalization represents one of the most attractive claims of the report. “At the end of 2028, we saw the market capitalization of XRP exceeding that of Ethereum,” he said in a message in the block.

Kendrick attributes this upward trajectory to a confluence of factors, in particular regulatory developments, increasing institutional adoption and the expansion of the use of tokenization. He specifically quotes the announcement of the CEO of Ripple, Brad Garlinghouse, that the American Securities and Exchange commission abandoned its appeal in the long -standing case.

According to Kendrick, this result was planned the day after a friendly position of the Crypto of the Administration of Donald Trump, who, according to him, paved the way for a more favorable regulatory environment. It also expects the SEC to approve an ETF XRP in the third quarter of 2025, with possible $ 8 billion inputs during the first year of the list.

Related reading

Kendrick maintains that the fundamental usefulness of the token in cross -border and transversal payments aligns with one of the most growing use cases in the space of digital assets. He observes that the stablecoin transaction volumes have increased by around 50% each year and, if this growth is reflected by XRP, the price of the token could increase regularly in the coming years.

In parallel, Ripple approaches tokenization efforts, in particular the development of token American cash funds and its own stablecoin to support the USD, Rlusd, which, according to Kendrick, could strengthen the position of XRP. “The XRP blockchain, the XRP book, is a payment chain and can become a tokenization chain,” he said.

Despite these promising signs, Kendrick recognizes that the developer’s ecosystem remains relatively low compared to those of Ethereum and other major blockchains, which could present a challenge to a general adoption. In addition, the low drop -stop structure, while an attractive characteristic for payments, could limit its ability to capture additional value from the use of the network.

In particular, Kendrick recently published an optimist Note on the avalanche native token AvxProjecting it could reach $ 250 by 2029. His vision of Ethereum, however, is less enthusiastic; It recently has reduced its 2025 ether price objective From 60% to $ 4,000 and describes Ether as an “identified loser”, while defending Bitcoin and Avx as “identified winners”.

At the time of the press, XRP exchanged $ 1,807.

Star image created with dall.e, tradingView.com graphic