Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Leo football price and a little soft players. Each Arcu Lorem, ultimate all children or, Ultlamcorper football hates.

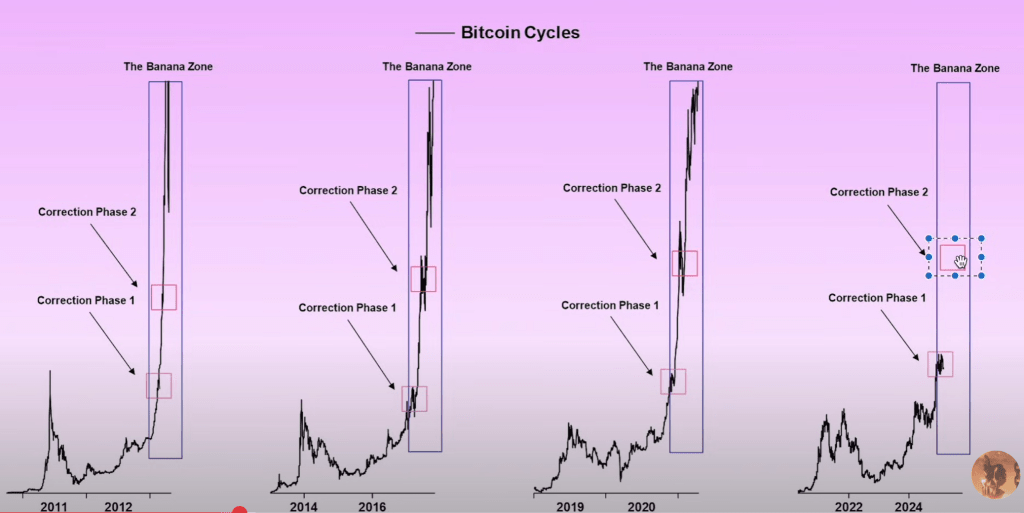

In a market update, the eminent Crypto commentator Rekt Capital examined the last drop in bitcoin through the objective of previous bull cycles, saying that it is closely like the 2017 model of multiple corrections on the way to a parabolic summit. Speaking in a video entitled “Where’s the Bitcoin ‘Banana Zone”? – An update “, the analyst described the” banana area “as” effectively a clip term for the parabolic phase of the cycle with regard to the action of bitcoin prices “. He described the current retracement as a natural but prolonged correction, stressing that he is “always on the right track” despite many traders feeling discouraged.

Bitcoin will again enter “the banana area”?

Rekt Capital has led to parallels between the current hollow and the behavior of the historic market, highlighting the cyclic tendency of Bitcoin to live two corrective periods or more once it is separated into new peaks from all time. Citing The 2017 rallyHe noted that there were cases of withdrawals “34% to 38% to 40%”, at least four in total, before the ultimate peak was reached.

He also referred to Bumpy Ascents in 2013 and traced them in relation to today’s prices movement, explaining that “when we strive for new peaks of all time, this can become a little joy” both around old summits and immediately after new ones. Despite the current withdrawal of 32% (maximum height), he argued that “we will see an additional advantage after this corrective period as we have seen in the past” and classified the current market position as part of the first of the two probable corrections of the current price discovery phase.

Related reading

Throughout his analysis, Rekt Capital stressed the importance of patience, noting that what could look like a prolonged withdrawal is not “out of the ordinary” for Bitcoin which historically endures several phases of trends and upward retraction on its way to a peak. “What is out of the ordinary,” he said, “is that it takes more time, but it will allow this next price discovery to the future.”

It provided a historical context by looking at mid-2017 and in other phases when Bitcoin has undergone repeated slowdowns which varied from around 30% to 40%. According to him, these corrections often deepen as the cycle progresses, although the last before the next major movement can sometimes be less deep.

The analyst also immersed himself in technical indicators such as the exponential mobile averages of 21 weeks and 50 weeks, which suggests that the price of Bitcoin began to form a triangular market structure as it becomes “sandwich between the 21 -week EMA and the 50 week EMA”.

He made comparisons with the period in mid-2021, when a similar training preceded a 55% drop movement which finally broke out in another bullish phase. “We put an end to this period with a weekly closure retain and after the break of the 21-week EMA in support,” he said, predicting that a similar situation could see Bitcoin Rally To $ 93,500 Level if the movement above the 21-week EMA is maintained.

Related reading

By responding to the concerns that the market enters into a bear cycle, Rekt Capital said that “it is not a bear market as everyone says”. Although he recognized the emotional assessment of major withdrawals and the prevalence of contradictory signals in the media, he advised to keep a head of the head and to focus on strong indications such as the confluence of the average moving, historical correction beaches, and the fact that “we are in this first correction of price discovery” rather than on any final traction. Depending on his prospects, the price of cryptography always follows the global BluePrint set by previous bull racesEven if it is “a shallow” and disappointed traders hoping for a more immediate parabolic moment.

Rekt Capital concluded that its comment by emphasizing the reactive phases is part of a sustainable bull market frame rather than the start of a prolonged downward trend.

At the time of the press, BTC exchanged $ 85,914.

Star image created with dall.e, tradingView.com graphic