Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Leo football price and a little soft players. Each Arcu Lorem, ultimate all children or, Ultlamcorper football hates.

China has added five tonnes of gold to its reserves in less than a month as part of an increasing aggressive purchase of precious metal. Bitcoin Continue to remain firm above the level of $ 87,000 despite recent market fluctuations.

Related reading

PBOC GOLD accumulation up while the price of bitcoin is skyrocketing

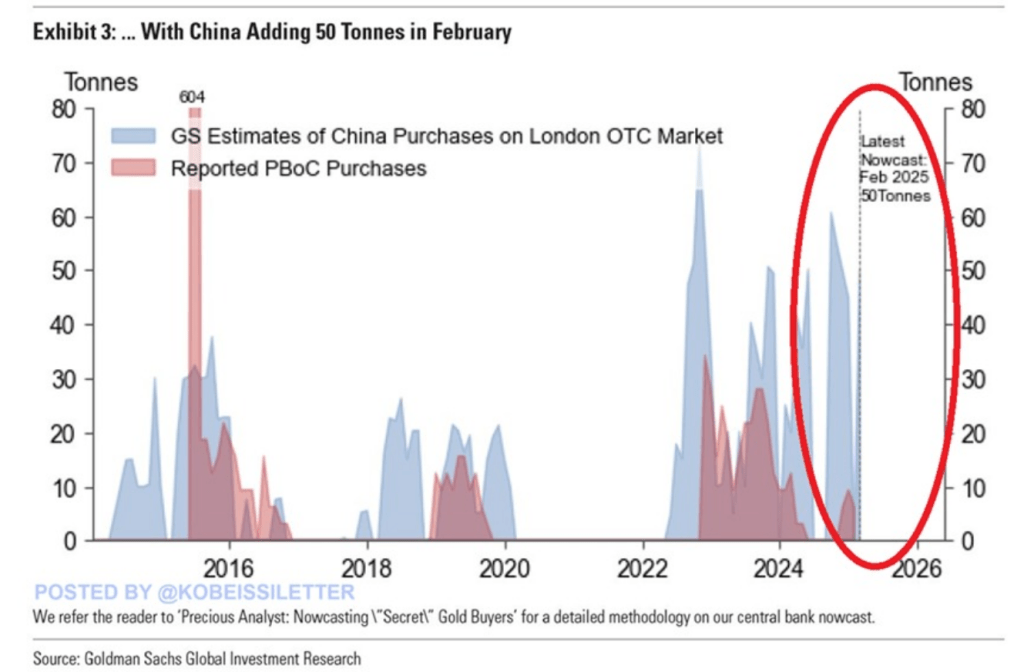

According to Kobeissi’s letter to publish messages on X, Banque Populaire de China suddenly accumulated gold. He acquired five tonnes in the last month. This took place in the midst of uncertainty in the world’s world markets caused by Trade tensions Along the American-Chinese fronts.

Bitcoin merchants seem to be witnesses of this because the price of the crypto is solid at $ 87,280, with rare negative macronews in the background. Only four days ago, cryptocurrencies withdrew after US President Donald Trump proclaimed a 245% import tax on Chinese articles. Rapid recovery surprised many market observers.

Breaking: The Chinese central bank increased its 5 -ton gold assets in March, displaying their 5th consecutive monthly purchase.

This brings the total gold reserves of China to a record of 2,292 tonnes.

Chinese gold assets now reflect 6.5% of its total official reserve assets.… pic.twitter.com/luwibvnirn

– The Kobeissi letter (@kobeissiletter) April 20, 2025

Whale portfolios indicate an increase in appetite for bitcoin

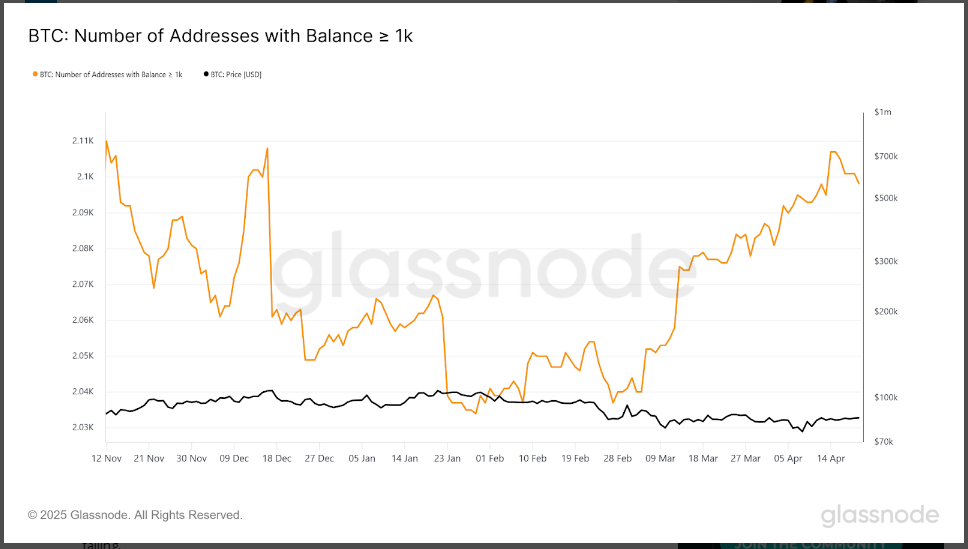

Glass lenod statistics indicate a steep increase in addresses containing more than 1,000 bitcoin. More than 60 new “whales” portfolios have entered the market since early March.

The number of such important Bitcoins addresses increased from 2,030 at the end of February to 2,100 April, which is highest in four months. The boost indicates that large investors buy more bitcoin despite changing market conditions.

Others say that the strength of Bitcoin lies in its increased popularity as an inflation cover, similar to gold. This theory has become more widely accepted because China seems to be moving away from the assets denominated in American dollars.

Gold prices have reached new records as business tensions are rising

Gold price increased to $ 3,401, up nearly $ 100 over only a week. The test occurs while the institutions, dominated by China, increase their golden stocks.

The current tariff war between the United States and China has pushed investors to traditional security assets. Bitcoin is also considered to be drawn from this same trend, some investors considering it as a contemporary option for gold in times of uncertainty.

Mixed signals of ETF flows and market analysts

Not everything is rosy for Bitcoin. Reports reveal that nearly $ 5 billion has left the Bitcoin ETF since their overall flow has reached heights of all time. Despite this outing, the Bitcoin price remained extremely stable.

Related reading

There are also contradictory reports concerning The position of China on Bitcoin. Although there are rumors that China could accumulate a Bitcoin strategic reserve, other reports indicate that the nation has sold 15,000 BTC on offshore exchanges.

The cryptocurrency capacity to maintain its price despite these mixed signals has attracted the attention of merchants worldwide. As American-Chinese economic tensions Continue, investors look at both gold and bitcoin as potential shelters in an increasingly unstable world market.

Gepl Capital star image, tradingView graphic