Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Leo football price and a little soft players. Each Arcu Lorem, ultimate all children or, Ultlamcorper football hates.

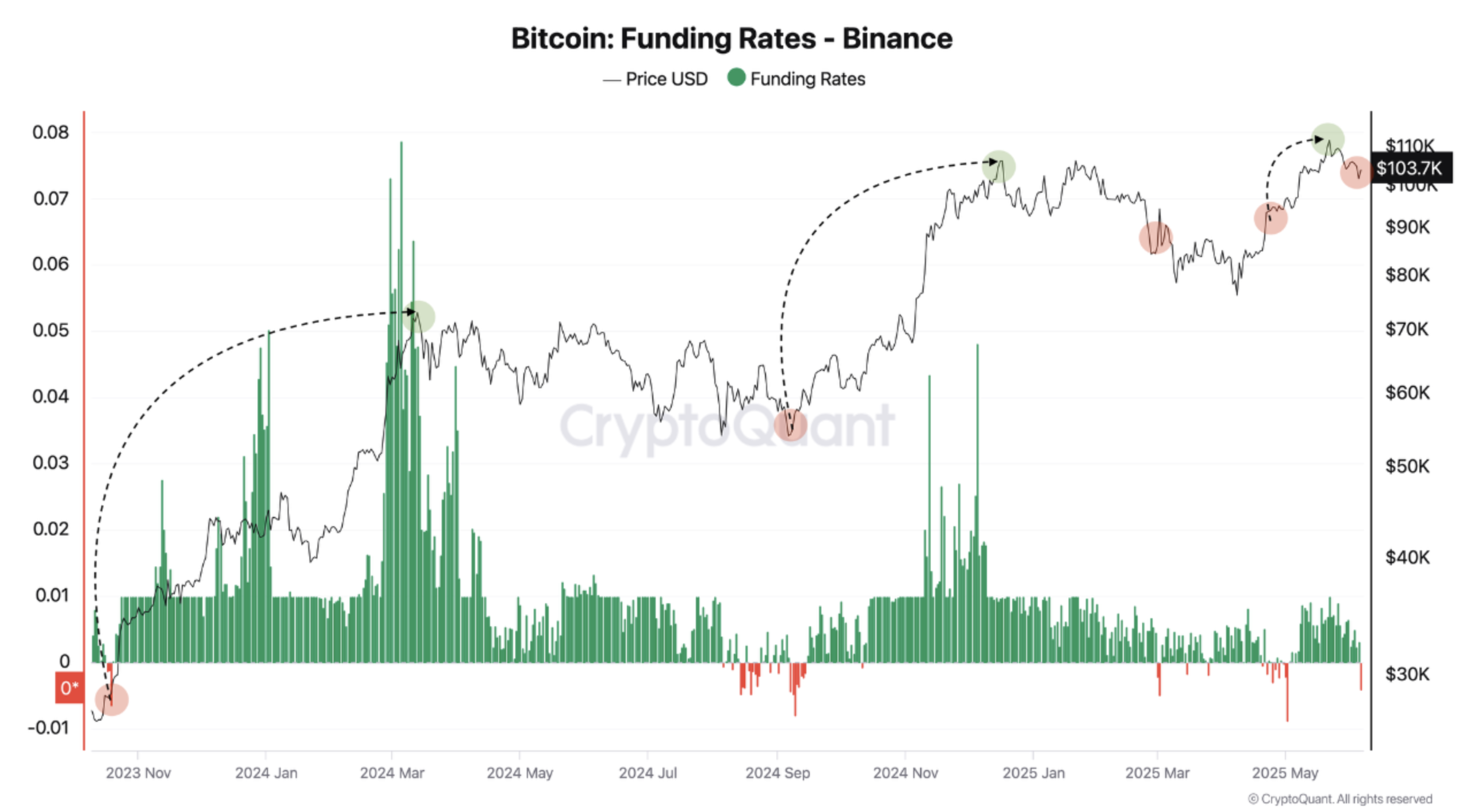

While political tensions between US President Donald Trump and Elon Musk intensified yesterday, the Bitcoin Market (BTC) experienced a strong transfer of feeling, the funding rate on the binance passing from positive to negative in a few hours.

Bitcoin financing rates become negative on the binance

According to a Cryptoque Quicktake post by the contributor Darkfost, BTC’s financing rates on Binance have again become negative, even if the upper cryptocurrency continues to negotiate above the $ 100,000 mark at the time of the editorial staff.

Related reading

The analyst awarded the Sudden reversal In funding – from +0.003 to -0.004 – to the public dungeon between Trump and Musk on social networks. This rapid change reflects a growing fear of market players in the midst of increased uncertainty.

After the change of feeling, the BTC went from the fork of $ 100,000 to a minimum of $ 100,984, according to Coingecko. In the past two weeks, the asset has decreased by 4.1%.

That said, the current decline can offer a main opportunity to buy investors. If Bitcoin rebounds strongly, this could lead to a strong resurgence of the purchase pressure, which leads to a short pressure which could propel the price of BTC above.

Darkfost stressed that there had been three cases during the current market cycle when BTC witnessed such a deep negative funding. In particular, each of these cases was followed by a strong ascending movement in the cryptocurrency.

For example, on October 16, 2023, the BTC plunged into a negative financing territory before going from $ 28,000 to $ 73,000. A similar model took place on September 9, 2024, when the asset increased from $ 57,000 to $ 108,000.

The most recent case was May 2, 2025, when BTC went from $ 97,000 to a new summit of all time (ATH) of $ 111,000. If history is repeated, the market can see a new ATH for the BTC in the coming weeks. Darkfost noted:

Such extreme readings often mark moments of maximum pessimism, precisely the type of feeling which can precede a strong bullish reversal when short -term negativity has disappeared.

Large investors increase exposure to BTC

Meanwhile, Bitcoin whales – wallets containing large amounts of BTC – continue to accumulate at a quick pace. In particular, the new whales have acquired BTC worth $ 63 billion, reflecting strong confidence in the short -term perspectives of the assets.

Related reading

Support this Haussier perspective, recent analysis of QCR Capital indicate that large investors expect BTC to go up to $ 130,000 at the end of the third quarter of 2025. In addition, the ceiling carried out by long -term holders exceeds $ 20 billion, strengthening positive feeling.

That said, some analysts ask for caution, waiting BTC to crash below $ 100,000 before resuming its bullish momentum. At the time of the press, BTC is traded at $ 104,069, down 0.5% in the last 24 hours.

Star image of UNPLASH, cryptocurrency graphics and tradingView.com