Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Leo football price and a little soft players. Each Arcu Lorem, ultimate all children or, Ultlamcorper football hates.

The data on the chain show that Tron (TRX) observed a sharp increase in profit earlier in the month. What type of holder was responsible for the move?

Tron Sopr saw a huge peak earlier in the month

In a cryptocurrency quicktake jobAnalyst Maartunn spoke of the recent trend in the Production profit ratio spent (SOPR) of Tron. The SOPR refers to a chain indicator which indicates to us if TRX investors move or sell their parts to profit or to a loss.

The indicator operates by passing through the transfer history of each part under travel to see at what price it was transgeated for the last time. The parts that have this cost base higher than the current cash price contribute to the realization of losses, while those who have the configuration opposed to the realization of the profit.

Related reading

The SOPR takes the ratio between the basis of the value spent and the cost, and sums it up for all the parts sold on the blockchain to find a clear situation for the market as a whole.

When the value of the indicator is greater than 1, this means that investors make an average profit through their transactions. On the other hand, the metric being under this threshold suggests the domination of the realization of losses on the market.

Now here is the graphic shared by the Enteleur which shows the trend of the Sopr Tron in the past year:

As displayed in the above graph, the SOPR tron saw a huge peak above brand 1 earlier in the month, which implies that investors participated in a large amount of profits.

According to the graph, it is also visible that there have been other peaks in making profits in the past year, but the current one stands out from its scale. The last peak of the metric saw its value increase to 4.74, corresponding to a profit margin of 374%.

“With TRX at the price of $ 0.268 at the time, the average acquisition price of these parts would have been about $ 0.0566,” explains Maartunn. Interestingly, Tron has not seen prolonged periods around this price mark since the end of 2022, which means that the tokens would have been held for a while before being treated this month.

Usually when dormant hands Breaking their silence, it is likely that it is for purposes linked to sale. That said, this is not the only reason they can do. “The activity could be linked to the first investors making the gains, the internal transfers or the reallocating decisions,” notes the analyst.

Related reading

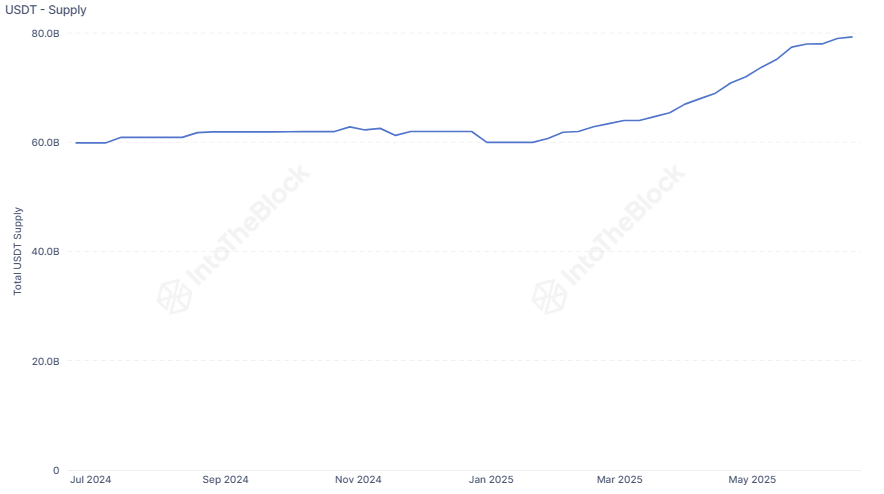

In other news, the USDT The supply on the Tron network has reached a new step, as the supplier of Sentora Institutional DEFI solutions (formerly Intotheblock) stressed it in an X job.

There are now more than $ 80 billion in USDT offers circulating on Tron, the second higher of any cryptocurrency network.

TRX price

At the time of writing the editorial staff, Tron is negotiated about $ 0.273, up 0.5% in the last 24 hours.

Dall-E star image, intotheblock.com, cryptotics.com, tradingView.com graphic