Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Leo football price and a little soft players. Each Arcu Lorem, ultimate all children or, Ultlamcorper football hates.

Bitcoin returned to his familiar price range during the week after a drop in last weekend Price at just under $ 99,000. This was followed by a price rebound of $ 106,000, which gave the Bulls a reason to remain hope.

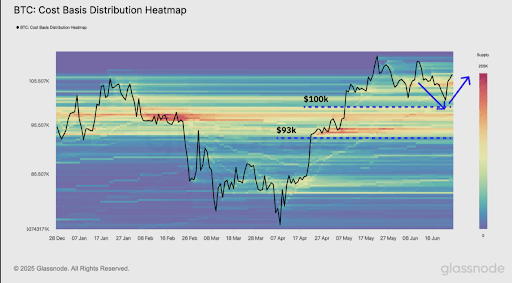

However, chain data show that certain cracks are deeper forming under the surface. The last Chain data of The Glassnode analysis company shows growing signs of fatigue on the Spot and term markets. These are conditions which can again cause the postponement of $ 99,000 in Bitcoin.

Price support is held, but the momentum is clearly missing

Bitcoin has gone through several price oscillations in recent days, But he has returned to the narrow band from $ 100,000 to $ 110,000 that has defined the market structure since early May. Glassnod chain data shows that a strong accumulation between $ 93,000 and $ 100,000, which is visible on the Delta cumulative volume (CBD), has so far served as a buffer zone which has helped Bitcoin prices to rebound during the most recent geopolitical volatility. However, the volume of the market indicates that this structural support could soon face additional pressure.

Related reading

According to the latest weekly Glassnode report, investor profitability and commitment The surrounding bitcoin cools quickly. More specifically, a third major wave of profit leads to the average profits made of 30 days, and chain activity has decreased considerably. The 7-day mobile average of the chain transfer volume dropped by around 32%, against a peak of $ 76 billion at the end of May at $ 52 billion during the recent weekend. The current volume trading in the current volume, which is now only $ 7.7 billion, is below the volumes observed during previous rallies.

The lack of strong enthusiasm for purchasing the Spot market shows that the bullish feeling has been replaced by caution. As such, the risk of rupture less than $ 99,000 increases unless another wave of demand returns.

The long -term market is also reflected

The slowdown in feeling is not limited to the cash market. Although Bitcoin arouses the interest of derivative exchanges, there are clear signs that the feeling of term contracts is declined. Open interest dropped 7% over the weekend, from 360,000 BTC to 334,000 BTC, and financing rates have been decreasing regularly since Bitcoin reached its first quarter of 2025.

Related reading

The long -term market players had been very active thanks to the Bitcoin rise at $ 111,800 in May, but their conviction seems to be vanishing now. Another indication of increasing reluctance to hold long positions is the sharp drop in the annualized financing rate and the 3 -month rolling base.

Without a stronger directional conviction, the term markets may not provide the necessary advantages to push Bitcoin to new heights. This situation can rather contribute to additional drop pressure.

So far, Bitcoin respected the Support zone of $ 93,000 to $ 100,000, which was strongly accumulated during the higher training of the first quarter of 2025. However, with volumes of low points, the slowdown in the activity on the chain and the feeling of future cleansing, this support could be tested again. If market players with a cost base in this area are starting to sell, the resulting pressure could drag the bitcoin again below $ 99,000 Next week.

At the time of writing the editorial staff, Bitcoin is negotiated at $ 107,100.

Pixabay star image, tradingView.com graphic