Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Leo football price and a little soft players. Each Arcu Lorem, ultimate all children or, Ultlamcorper football hates.

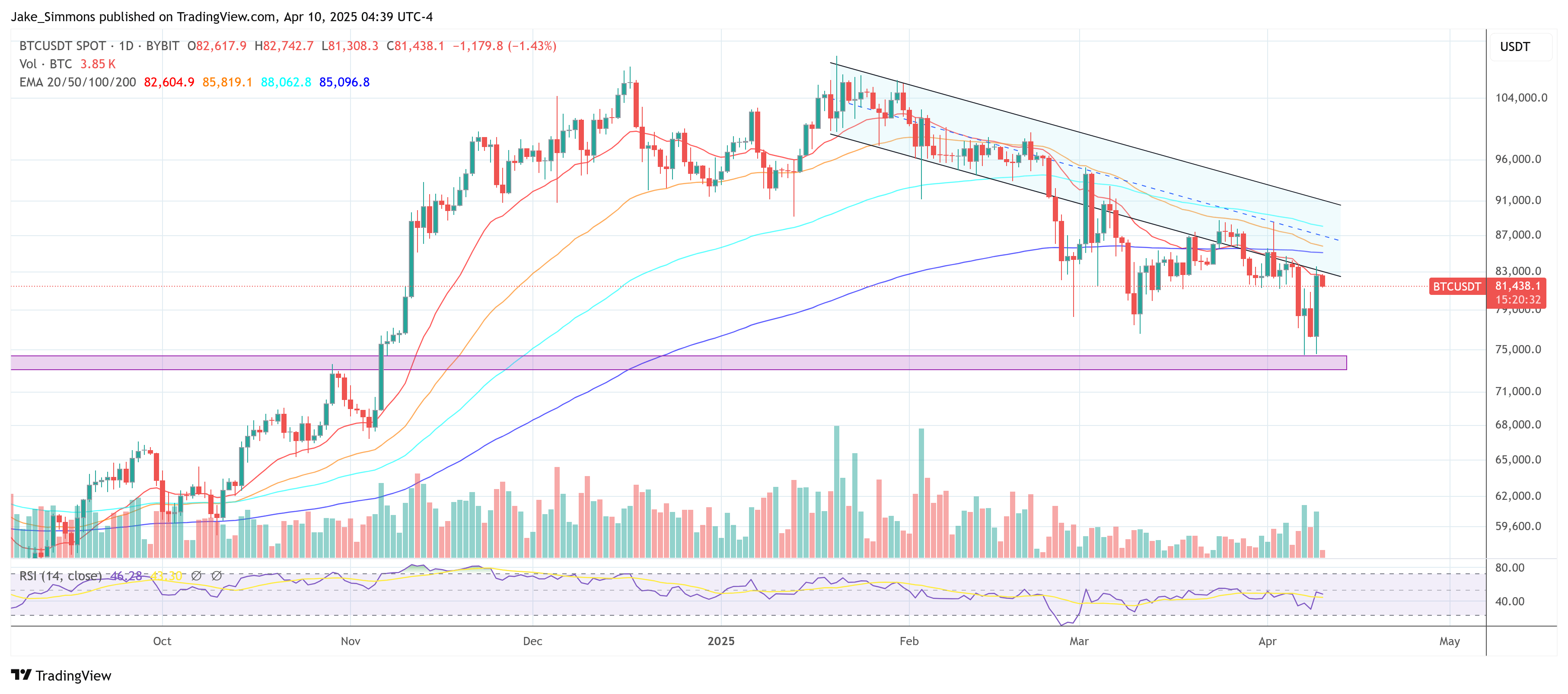

On Wednesday, Bitcoin increased by more than 8% to reach a summit of $ 83,588 after the announcement by President Donald Trump of a 90 -day break on new reciprocal prices for more than 75 countries, excluding China. Investors and market analysts considered the decision as a relief signal, reflecting the hope that the rapid climbing of prices would decrease, at least temporarily. However, President Trump simultaneously increased the rate of tariff on China to 125%, indicating that the commercial battle between the two largest economies in the world remains far from being settled.

Trump’s decision to suspend most of his newly announced prices was linked to concern disruptive changes on the bond market. Yields on 10 -year cash tickets, which had climbed at a seven -week summit, remained high after the revelation of the price break. Despite the temporary relief of many countries, the immediate price hike on China highlighted the current impasse, suggesting persistent uncertainty for the global markets. Some analysts see the overvoltage of risk assetsIncluding Bitcoin, as partly motivated by the evolution of expectations concerning future negotiations.

The potential agreement in China is not a price for Bitcoin

In the middle of this backdrop, Joe McCann, founder, CEO, CIO, and GP GP solo of asymmetrical crypto fund, voiced Its perspective on X, observing that the market was originally pricing for prices for China, the EU and the whole world, but is now only striculating China.

Related reading

He indicated that an agreement with Beijing remains unrivaled, so if a breakthrough emerges, the market “explodes” above. “The market was at the cost of China, the EU and all the other tariffs. The market is now drained only China. The market did not cut an agreement in China, ”notes McCann.

He also notes that “long -term explosion is the risk that parity cloves explode”, referring to sudden market movements in long -term bonds. McCann considers the current environment as recalling the background of the market during the cocovated period, the funds starting to criticize the exposed positions and sellers. He underlines the possibility that if the yuan is strengthening against the dollar, this would probably mean that China is ready to negotiate, which implies that the equity markets and cryptography could be negotiated too low.

“But today, long funds only reprinted and the short films covered.

“Not yet out of the woods”

Jeff Park, chief of Alpha Strategies in Bitwise, warned That the environment remains fragile, noting on X which has weakened the dynamics of the Yuan, an even more robust yield of 10 years above 4% and continuous credit problems to deviations beyond 400 basic points persist as a potential front wind. According to him, “[this] will be an unpopular opinion […] We are still in the woods […] The net profit is always negative for risk assets ”, especially if the federal reserve does not reduce rates as planned previously.

Related reading

He cited this lack of monetary support as a factor that amplifies volatility. “If anything, it is actually more concerning the little liquidity on the market to discover casino swings like this,” he wrote via X.

The X Adam Yoder user agrees that “obligations have further increased today, gold has increased”, which suggests that there is still enough security flows to keep traditional investors suspicious of risky assets. Park agrees, suggesting “it is in fact a kind of horrible movement” and expressing its confusion on what the White House hopes to achieve with a partial break which leaves China alone to wear the brunt.

Meanwhile, in a rapid reversal of his previous call, Goldman Sachs retire A recently announced reference after confirmation of the 90 -day break. Its revised prospects, published by Jan Hatzius, maintains that total prices – both the existing rates of 10% and expected specific to 25% – will always be implemented, but that the market has been spared an immediate global escalation.

Goldman is now going back to its previous reference forecasts for recession for GDP growth of 0.5% in Q4 / Q4 in 2025, a probability of recession of 45% and three “insurance” of 25 successive basins of 25 points of 25 points Cuts by the federal reserve In June, July and September. According to the press release, “we continue to expect at additional sectoral prices” and at a global rate which could tackle the increase in 15 percentage points Goldman had initially planned.

All eyes on the release of today’s ICC

In particular, today, data from the consumer price index in the United States (ICC) for March 2025 should be published by the American Labor Statistics Bureau (BLS) at 8:30 am he – a large report for the market that could be crucial for the next BTC movement.

The IPC for February 2025 showed an increase from one year to another (annual sliding) of 2.8% (not adjusted seasonally), with an increase of the month to more (MOM) of 0.2% (adjusted seasonally). The basic ICC, excluding food and energy, increased by 3.1% in annual sliding. This marked a slight cooling compared to the rate of 3.0% in January in annual sliding, suggesting a trend in progressive disinflation.

Expectations for the Mars IPC potentially fell to approximately 2.5% in annual sliding, some analysts suggesting that it could even drop to 2.6% or less if housing costs, rents and energy prices continue to relieve themselves. The basic IPC should hover about 3.0% to 3.1% in annual sliding, reflecting the persistent pressure of shelter services and costs.

At the time of the press, BTC exchanged $ 81,438.

Star image created with dall.e, tradingView.com graphic