Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Leo football price and a little soft players. Each Arcu Lorem, ultimate all children or, Ultlamcorper football hates.

While gold continues to define new heights of all time (ATH) – trade At $ 3,333 per ounce at the time of writing this document – Bitcoin (BTC) experienced a more moderate price action, consolidating in the $ 80,000 range. However, analysts suggest that the best digital asset could soon reflect Gold’s recent momentum.

Bitcoin is ready to follow the momentum of Gold?

In a recent job On X, Crypto Trading counts Cryptollica has suggested that BTC could be ready to reproduce the Gold’s historic price movement in recent months. The account shared the following table, highlighting the striking similarities between gold and BTC price actions.

The graph shows both gold and BTC forming a macro-foundation around the beginning of 2023, followed by a rejection at the top of the range at the beginning of 2024. The gold finally broke out in the following months, while the BTC has slightly delayed, moving around November 2024.

Related reading

According to Cryptollica, the BTC now seems to come out of a consolidatory corner model, with a potential mid-term target of up to $ 155,000. Currently, ATH Bitcoin is $ 108,786, recorded earlier this year in January.

BTC is also likely to benefit from several favorable macroeconomic trends. For example, the global M2 monetary mass should increase In 2025, a development which generally supports risky assets such as Bitcoin.

BTC ripening as an asset of refuge

Beyond models of technical graphics, the BTC has demonstrated a remarkable resilience In the middle of the climbing of global uncertainty induced by prices. According to the latest weekly report on the channel, Gold and BTC performed well during the current pricing war. The report note:

In the middle of this turmoil, the performance of hard active ingredients remain remarkably impressive. Gold continues to climb higher, having reached a new ath of $ 3,300, while investors flee to the traditional assets of Safe Haven. Bitcoin has sold $ 75,000 initially alongside risk assets, but has since recovered the gains of the week, exchanging up to $ 85,000, now flat from this flash of volatility.

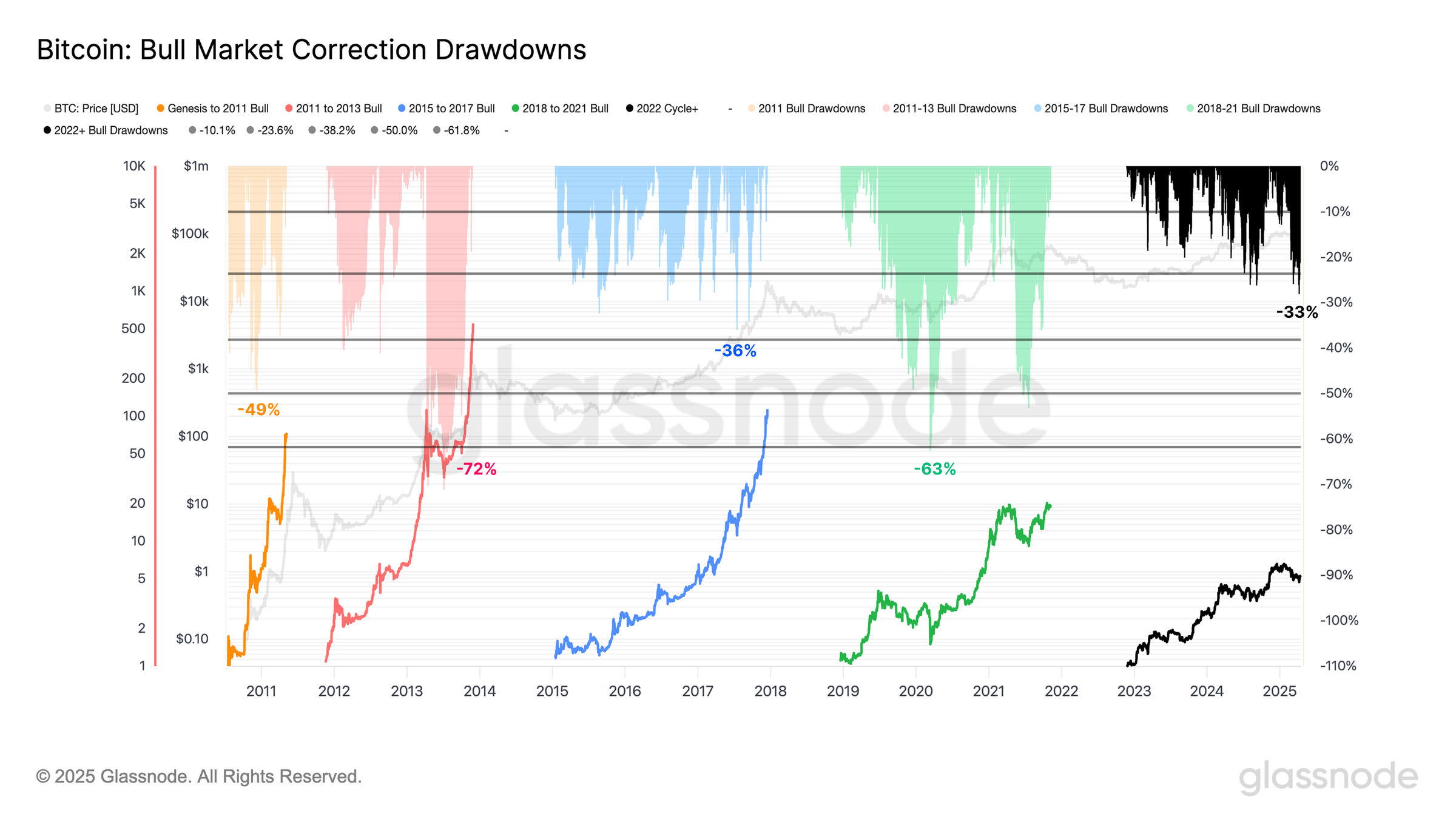

The report also mentions that the BTC recently experienced its highest price correction in cycle 2023-2012, a draw at -33% of its ATH earlier this year. However, this correction remains relatively modest compared to those observed in previous market cycles.

Related reading

The following graph illustrates the bolt market correction withdrawals since 2011. As the recent correction of -33% has been the deepest correction among the past cycles, the deepest being -72% during the Haussier 2012-2014 market.

While the BTC continues to show signs of maturation as a reliable actor in the period of geopolitical uncertainty, institutional investors appear make profits. This is highlighted by the recent outings of the Bitcoin (ETF) negotiated funds. At the time of the press, BTC is negotiated at $ 84,694, up 0.7% in the last 24 hours.

Star image of Unsplash, X charts, Glassnode and tradingView.com