Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Leo football price and a little soft players. Each Arcu Lorem, ultimate all children or, Ultlamcorper football hates.

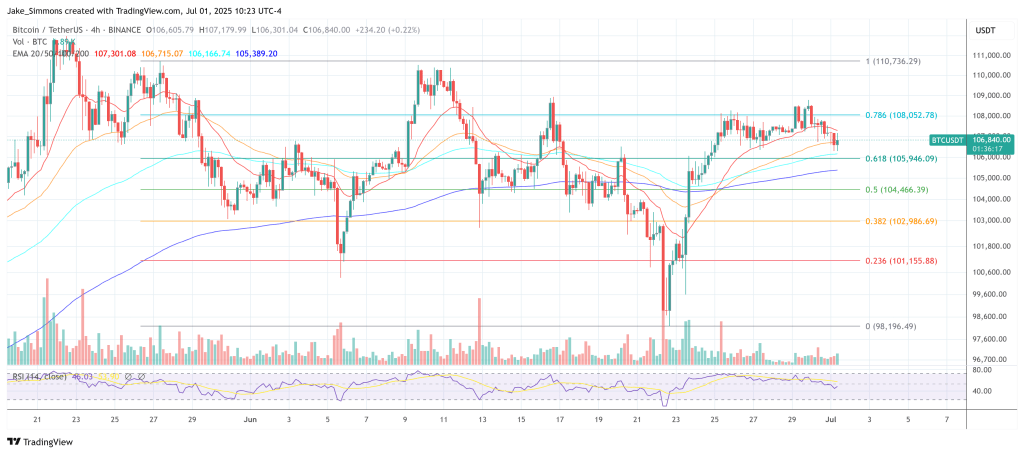

The last compass of the European Bitwise crypto market lands like a horn: each large gauge of the risk appetite, liquidity and dynamics of macro is swinging in favor of bitcoin, and the company arguments This decision could “provide a significant back wind” for the reference asset. The study notes that Bitcoin has already rebounded from $ 101,000 to around $ 108,000 last week, while traders would digest a powerful coolant inflation cocktail, defrosting geopolitics and an increasingly dominant federal reserve position.

Perfect Storm Brewing for Bitcoin

The feeling of feeling of crypto -assembly owner of Bitwise has reached its most optimistic reading since May – “Now report clearly[ing] An bullish feeling again, ”write the authors. Behind this overvoltage is an unprecedented torrent of capital in products negotiated in exchange: the cumulative net entries with global Bitcoin ETPs have reached a record of $ 14.3 billion, with five consecutive consecutive possibilities, adding another battery. the price of bitcoin, ”explains Bitwise, adding that US Spot Etfs are now on a 14 -day victories sequence which could eclipse the 16 -day record set shortly after the launch at the beginning of 2024.

Related reading

Why do investors suddenly kiss the risk? Bitwise underlines what he calls a “drop in macro uncertainty”. July can deliver new American trade In accordance with Canada, while Washington and Tehran took a surprisingly conciliatory tone; Former President Donald Trump even launched lifting sanctions if Iran remains peaceful.

In addition to that, President of the Fed Jerome Powell The time of resumption of rate discounts to progress during pricing talks – an alignment that leaves the door open to more loose politics in a few weeks. The report summarizes the mood: “The trifecta of the decline in geopolitical risks, the uncertainty of trade policy and the potential stimulus of monetary policy should continue to raise the feeling of the market and provide a significant rear wind for bitcoin and other cryptographic assets.”

*** 𝗡𝗘𝗪 ***

We have just published our latest report 𝗕𝗶𝘁𝘄𝗶𝘀𝗲 𝗠𝗼𝗻𝘁𝗵𝗹𝘆 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗠𝗮𝗰𝗿𝗼 for 𝗝𝘂𝗹𝘆 𝟮𝟬𝟮𝟱!Here is the 𝗸𝗲𝘆 𝗸𝗲𝘆 of the relationship you need to know:

𝗝𝘂𝗻𝗲’𝘀 𝗕𝗶𝘁𝗰𝗼𝗶𝗻… pic.twitter.com/uybrwvre6e

– André Dragosch, phd (@andre_dragosch) July 1, 2025

Chain signals also seem to be started. Whale portfolios (1,000 BTC or more) withdrew 8,740 BTC from exchanges last week, the exchange reserves increased to 2,898 million BTC, or 14.6% of the offer – and net sales pressure on occasional sites increased from $ 2.2 billion to only $ 0.5 billion.

Related reading

The derivatives paint a more nuanced image: future open interests have slipped by 20,000 BTC, and the lower lowering funds indicate that the persistent short markets show that traders stand quietly – an open interest of the call fell to 0.59 while the implicit volatility of a month were supported around 38%. Interprets the combination of “short -term consolidation” in the face of a longer term trend intact in the longer term.

Traditional markets also disgust. The Bitwise cross risk appetite index (CARA) went from 0.31 to 0.49, strengthening the evidence that capital turns in transactions sensitive to growth. Some 70% of the vailed altcoins beat Bitcoin last week, an extent of the extent historically associated with the bull phases at the start of the cycle.

In its lower evaluation, the ILO stops short the price objectives but leaves little doubt about management: as long as geopolitical relaxation, commercial breakthroughs and a accommodator converge with implacable ETF entries, “a decisive yield in global risk appetite” is probably to maintain bitcoin on a rising trajectory. If we, the FNB Spot, guarantee only three other net input sessions this week – starting their 2024 record – the company suggests that the market can discover at what speed an asset limited to the offer can react when the macro wind blows on its back.

At the time of the press, BTC exchanged $ 106,840.

Star image created with dall.e, tradingView.com graphic