Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Leo football price and a little soft players. Each Arcu Lorem, ultimate all children or, Ultlamcorper football hates.

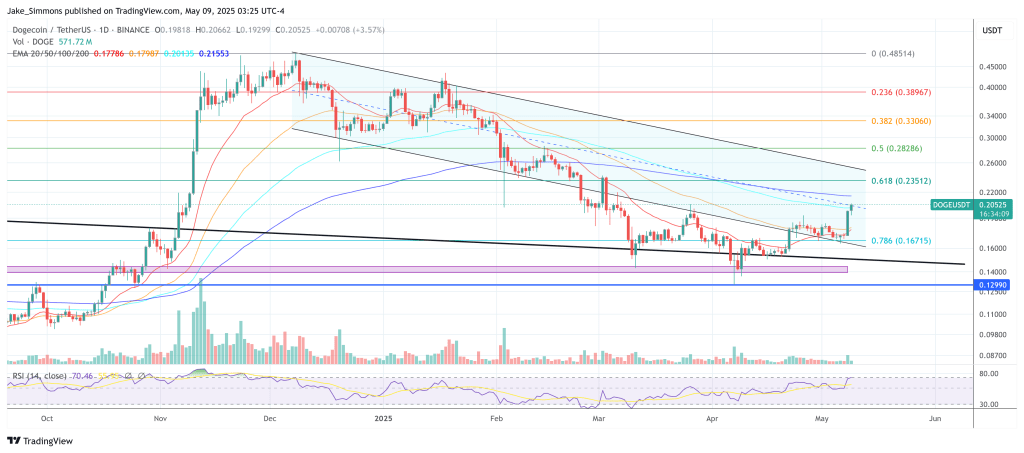

In his latest Youtube briefing at 292,000 subscribers, the analyst known as “More Crypto Online” (MCO) argued that Dogecoin’s recovery of support in early May maintains the largest Elliott-Wave roadmap in the same and, above all, leaves the advance for the region for a long time to the region of $ 0.60.

Dogecoin path at $ 0.60

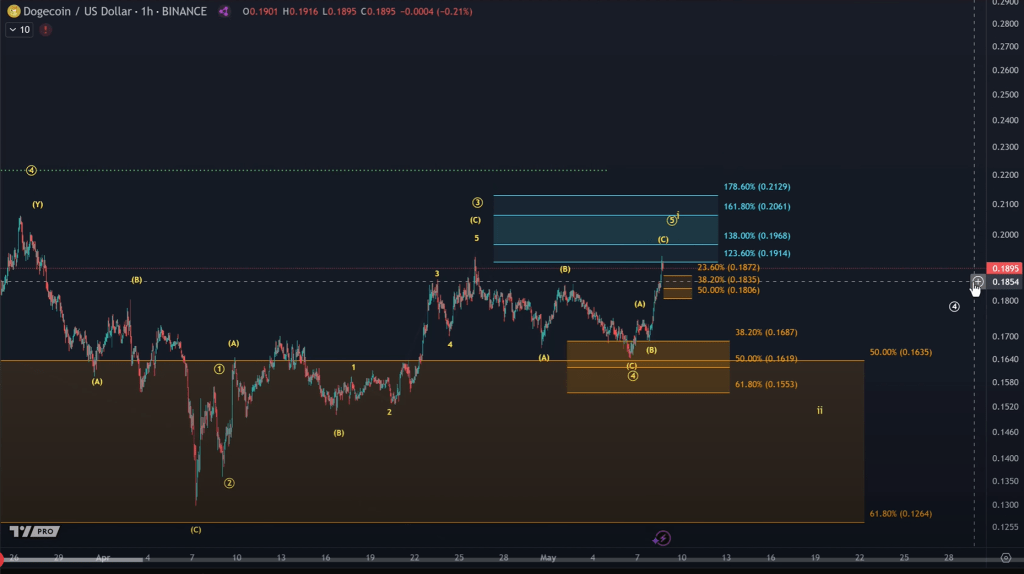

Speaking Less than forty-eight hours after the local Dogecoin bottom on May 6 at around $ 0.163, MCO underlined that the price action has so far respected the fourth wave Fibonacci trace that he has mapped during the previous sessions. “The price maintained this support area between 15.5 cents and 16.8 cents as a standard Fibonacci support in a four-wave,” he noted, adding that the rebound has already satisfied the “minimum” requirement for a fifth wave launch.

The short -term pivot of the analyst (one hour graph) remains the line of $ 0.18 – extremely the retrace to 50% of the impulse at the end of April. “As long as we hold above $ 0.18, there is absolutely no high sign,” said MCO, stressing that a decisive break below this threshold would force a re-evaluation of the intradible model and focus on May 6 to switch. He described $ 0.18 as the level which “allows continuation, continuation on the direct rise, in an increase in the increase”.

Related reading

Until now, Dogecoin’s last push has only retested the level of April 30 almost $ 0.193, leaving the fifth wave “not healthy enough to be really considered a fifth wave which is already completed”. The analyst therefore expects at least “one or two levels of fibonacci above the third wave”, distinguishing extensions of 123.6%, 138.2% and 161.8% as conventional zones which would validate a correctly extended fifth wave. The ideal target zone thus begins fractionally above $ 0.193 and could extend into the 20 cents low beach if the momentum remains intact.

MCO also mapped the contingency in which the market loses the floor of $ 0.18. Provided that the retrace resulting in corrective remains and, critically, is above 6 May at $ 0.163, it would consider the reverse as the “withdrawal of the B wave” in a “wider ABC structure” which ultimately propels the dogecoin to Fresh cycle tops. “This would allow a wider ABC structure … and the withdrawal of the B wave could simply be corrective, but must hold above May 6,” he explained.

Related reading

While the current segment focuses on the micro -structure – the fifth wave ends in a single push or turns into a more complex ABC variant – the analyst has reiterated that none of the described scenarios denies the higher thesis as long as the macro support band from $ 0.155 to $ 0.168 will survive. This framework always ends in a counting of the waves which projects Dogecoin to the psychologically significant region of $ 0.60 The pulse cycle takes place.

For the moment, the analyst’s dashboard remains simple: above $ 0.18, the burden of proof lies in the bears; Below, the market will probe if the corrective drop is only the prelude to the next leg and potentially decisive. As MCO concluded, “a direct movement remains the wait […] But a break below will then be, you know, forces this discussion. »»

At the time of the press, DOGE exchanged $ 0.205.

Star image created with dall.e, tradingView.com graphic