Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Leo football price and a little soft players. Each Arcu Lorem, ultimate all children or, Ultlamcorper football hates.

Cardano (ADA) enters a decisive moment while the bulls are fighting to contain the support area of $ 0.74 and strengthen the momentum for a movement to the level of $ 0.90. After winning more than 68% from its April levels, Ada shows solid signs of recovery, but he must defend the current levels to confirm the continuation. This phase is critical, because the action of prices tests a key demand zone which previously sparked a significant increase.

Related reading

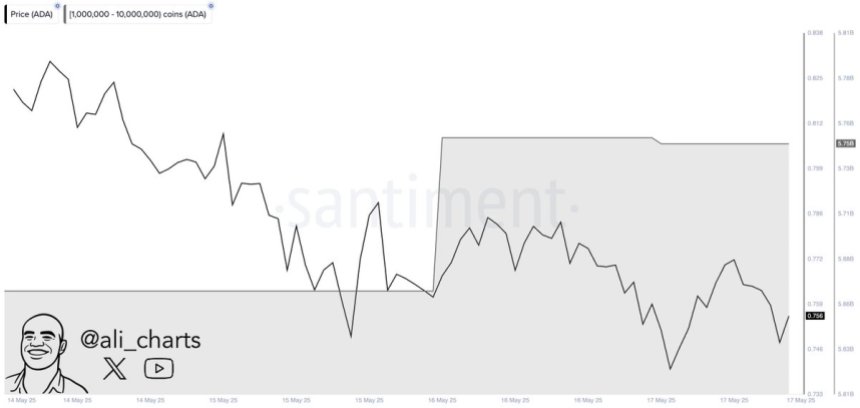

Adding to the bullish feeling, the data on the chain of santly reveal that the whales have accumulated more than 80 million ADA in the last 48 hours. This increase in the large -scale purchase activity indicates growing confidence among major players, potentially preparing the ground for an escape. Whales often lead to major market movements, and their renewed interest in Cardano can point out a rally supported in advance.

However, the level of $ 0.90 is now acting as short -term resistance, and recovery will be essential to unlock higher targets. The next few days should be essential for the ADA price structure. If the bulls manage to return this level, the next step could bring Cardano under the spotlight – prevailing possible wider Enthusiasm Altcoin in the process.

Whale strength accumulation signals: Buyers put pressure for an escape

Despite this impressive rebound, ADA remains 43% below its peaks in December 2024 around $ 1.32. This gap highlights the prudent optimism which dominates the landscape of Altcoin. While the bulls gradually regain control, overall fear of the market and macroeconomic uncertainty continue to put pressure on altcoins, many of which still have trouble crossing key resistance levels.

Ada is currently consolidating just above the level of $ 0.74, forming a base that could precede a break. The market structure is tightening and the next decision – down or down – will probably be clear. A decisive push above $ 0.90 would confirm an escape and probably trigger a renewal of the interests of retail and institutional investors.

Feeding this story is new data From the superior analyst Ali Martinez, who reported that the whales had bought more than 80 million ADA in the last 48 hours. This large -scale accumulation indicates growing confidence among major actors and could act as a catalyst for more increase. The activity of whales often precedes a strong price action, and this development supports the idea that ADA can be on the verge of an important decision.

As ADA is consolidated near the critical support and the interest of whales increases, market observers closely follow signs of continuation. If the bulls keep the momentum and break past resistance, Cardano could quickly move from a consolidation phase to a large -scale rally, potentially revive the momentum through the Altcoin sector.

Related reading

Cardano has crucial support because the bulls aim to recover

Cardano is currently negotiating around $ 0.74, testing a key support area after failing above the $ 0.80 bar. The graph shows a sharp increase in May which led Ada to local peaks close to $ 0.90, but since then, the price has been traced and is now consolidated just above its 200-day EMA (about $ 0.71). This level acts as a dynamic support and could be critical for the following.

The price structure suggests that ADA is decisive. Ventilation below the EMA and the horizontal support around $ 0.72 could expose the token to a deeper retracement to the previous consolidation zones. On the other hand, the recovery of $ 0.80 would invalidate the downside scenario and report a potential thrust to $ 0.90 and finally $ 1.00 – an area that marks high historical resistance.

The volume has decreased slightly during the recent withdrawal, which suggests that the retirement can be more motivated by taking the profits than the sale of panic. The 200 SMA above at $ 0.80 remains a key target to monitor the increased pursuit.

Related reading

If the bulls can defend the current levels and generate a renewed purchasing momentum, ADA could resume its upward trend and break the current beach, preparing the way for a retain for major resistance levels in the coming weeks.

Dall-e star image, tradingview graphic