Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Leo football price and a little soft players. Each Arcu Lorem, ultimate all children or, Ultlamcorper football hates.

Bitcoin is still negotiating around the $ 103,000 mark, although the momentum to the increase he started in May has exposed a slowdown Over the past seven days. Although Short -term volatility is currently playing, long -term perspectives are undoubtedly optimistic.

Related reading

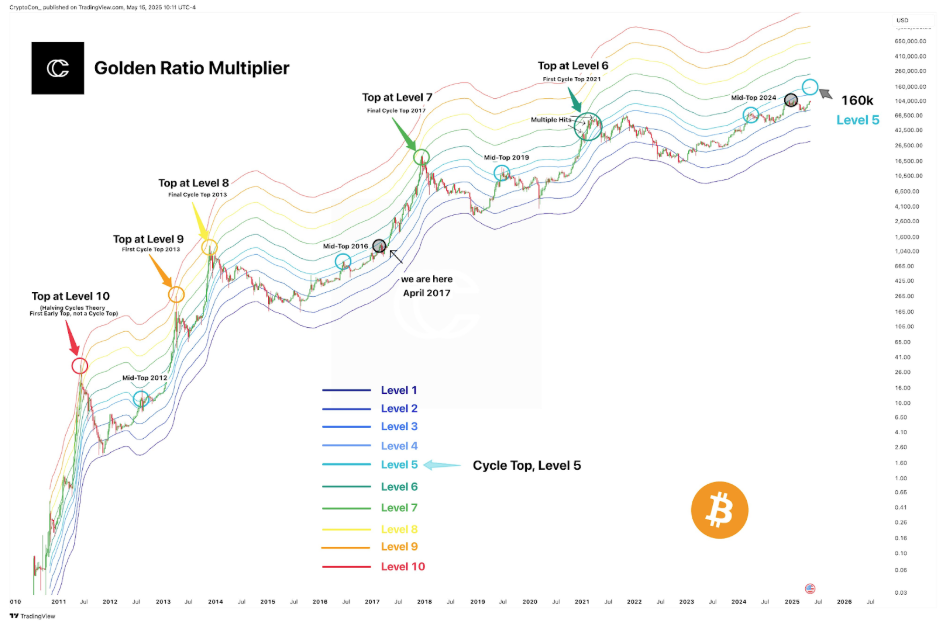

Some analysts seek to Long -term cycle indicators for management. Such a tool, the golden ratio multiplier, which called the Haut Bitcoin in 2021, resurfaced with another interesting top for the current Bitcoin cycle.

The gold ratio multiplier has identified the top of 2021, now points to a new peak

Take a Publish on the social media platform X, The popular Cryptocon Popular Analyst has highlighted the reliability of the gold ratio multiplier to predict the price of the price of bitcoin in each cycle. The golden relationship multiplier is a logarithmic model that incorporates fibonacci derived multipliers to anticipate Bitcoin macro trends.

In particular, this metric was among the rare to call the top of the April 2021 cycle in real time, the same as the prices of 2017 and 2013 prices. This cycle, the model has already reported a significant peak in March 2024, although the Crypto analyst interpreted this not as the final summit but as an environment.

Cryptocon explained that the action of bitcoin prices has already reached level 4 of the multiplier graph this cycle, but it is not the final peak. “We have already reached our high level cycle this cycle once, but it was for the cycle in the middle of March 2024, which means that we are forced to do it again,” he wrote.

The level 5 band is now about $ 160,000 and continues to get upwards. Saying a parallel with past cycles, Cryptocon noted that the structure of the current cycle shows strong similarities with the period 2015 to 2017, when Bitcoin saw a progressive accumulation followed by an explosive escape.

On the basis of this comparison, the current market phase is considered to be equivalent to April 2017, Just before Bitcoin takes place in a rally in the months that followed.

The Multiply Golden ratio suggests that $ 160k is the next major goal

The graph accompanying the cryptocon post depicts an image familiar with the golden multiplier relationship. Each strip, ranging from level 1 to level 10, is based on a multiplier level derived from the 350 -day mobile average. Bitcoin exceeded the different levels: level 10 in 2011, level 9 and 8 in 2013, level 7 in 2017 and level 6 in 2021. The peak of the current cycle should most likely be level 5, but bitcoin The price is not yet there.

Related reading

If the market continues to respect this structure, Bitcoin could prepare for a rally to the level 5 brand of $ 160,000 a little later in the year, which could mark the final summit of this cycle. The current range around $ 103,000 may well be Calm before the last escape. “A slower accumulation, then at the same time,” said the analyst.

At the time of writing this document, Bitcoin was negotiated at $ 102,971.

Felash star image, tradingView graphic