Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Leo football price and a little soft players. Each Arcu Lorem, ultimate all children or, Ultlamcorper football hates.

Ethereum is loud above the $ 2,500 mark after a two-week volatile section marked by strong resistance and an undecided price action. While the bulls successfully defended the main levels of support, ETH continues to fight against the wall of the offer just below $ 2,800. The wider market of cryptography reflects this lateral trend, with Bitcoin and total market capitalization also trapped in tight ranges, limiting the bullish impetus to all levels.

Related reading

Analysts are increasingly optimistic about the potential of a season in Alts -season – but only if Ethereum can convincingly recover the level of $ 3,000. A decisive break above this brand would signal renewed force and probably arouse a wider rally in altcoins, many of which have been late in recent weeks.

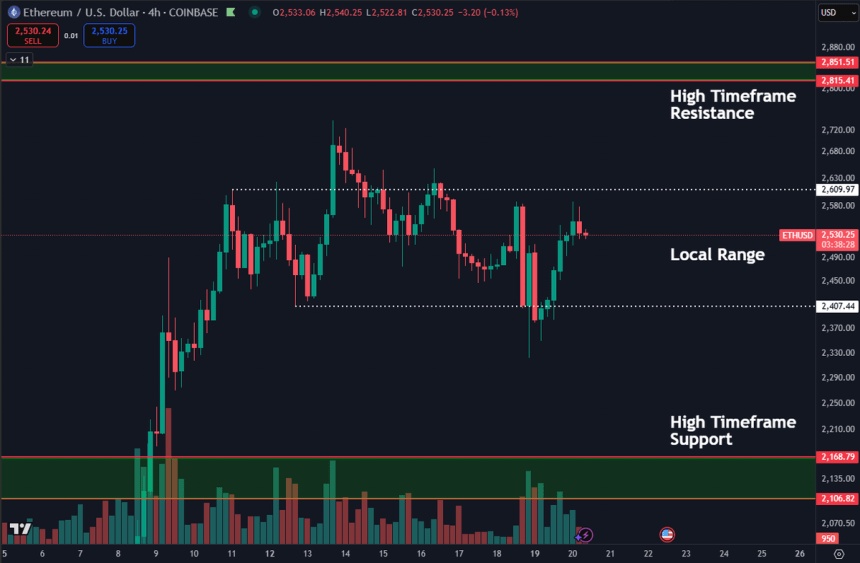

The best analyst Daan shared technical ventilation, noting that the action of Ethereum prices has been volatile in the past two weeks. He stressed that the ETH is currently linked to the range, a bit like BTC and the rest of the cryptography market. Until there is a unleashing From this local structure, traders remain cautious.

Ethereum Bulls holds a structure but the momentum cools off

Ethereum Bulls gained ground earlier this month when the price exceeded the level of $ 2,200 with ease, establishing an upward structure for the first time in weeks. The momentum accelerated quickly, ETH perverse $ 2,550 Sunday before being just as quickly in the $ 2,400 area. The rapid action from top to bottom highlights the current uncertainty on the market, where investors remain cautious despite recent force.

Sunday withdrawal added weight to the warnings of analysts that Ethereum could face short -term sales pressure before confirming the next step. While many remain optimistic on the medium -term eth trajectory, they recognize that the momentum has cooled and that the market stops to reassess.

Daan provided ideas In Ethereum’s behavior, describing prices’ action as “fairly disorderly” in the past two weeks. He stressed that ETH, like Bitcoin and the larger crypto market capitalization, is currently trapped in a tight range. According to Daan, he “does not try to do much before leaving at least convincingly from this local range”.

The defined beach is between $ 2,100 (key support) and $ 2,800 (major resistance). If Ethereum holds above the current levels and exceeds $ 2,800, it could trigger a new wave of bullish momentum. Until then, consolidation can persist.

Related reading

ETH is consolidated below the resistance because the bulls hold the line

Ethereum (ETH) is currently negotiated at $ 2,539 after a volatile week marked by strong bullish attempts and increasing pressure of resistance. The daily graph shows that ETH was trying to maintain above the 200-day EMA ($ 2,440.71), which has now become a short-term support area. Meanwhile, the 200 -day SMA is more at $ 2,701.31, acting as a key resistance level that Ethereum must overcome to confirm a sustained rally.

After a net rally at the beginning of May which propelled the ETH from less than $ 2,000 to more than $ 2,700, the price entered a period of consolidation. This break comes after several unsuccessful attempts at rupture and maintenance above the resistance of $ 2,700, just under the 200sma. The volume has decreased, and the recent price action suggests a battle between bulls trying to defend the level of $ 2,500 and pressing bears to increase the movements.

Related reading

The upward structure remains intact as long as the ETH remains above the 200EMA and in the range of $ 2,400 to $ 2,600. However, non-compliance with the current support could expose Ethereum to a deeper retirement around $ 2,200. For bulls, the recovery of $ 2,700 is essential to unlock the next leg to the psychological level of $ 3,000. Until then, traders should expect a jerky price action and to strengthen volatility.

Dall-e star image, tradingview graphic