Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Leo football price and a little soft players. Each Arcu Lorem, ultimate all children or, Ultlamcorper football hates.

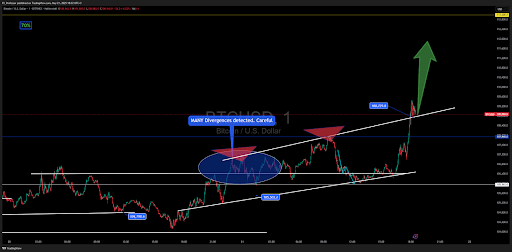

The action of bitcoin prices in the last 24 hours has been simply remarkable. After consolidating for several days in a tightening range, the market exceeded the resistance area for the support of $ 105,503 of the resistance which became earlier in the week and launched a steep ascent on the last day of negotiation. This allowed Bitcoin to push in new high levels of all time, and shows no sign of slowdown.

Interestingly, technical analysis shows that the rally stands out An approach to a golden cross Between the 50 and 200 days mobile averages, but FX_PROFESSOR offered a different vision of the golden Cross well-Celbratebrate.

The analyst challenges media threshing in golden cross as a late signal

In a recent Analysis published on tradingViewFX_PROFESSOR discussed a different version of the Bitcoin gold cross. While most market commentators interpret this crossing of the 50-day simple mobile average above 200 days as a strong bullish confirmation, the analyst rejected it as a delayed indicator. The analyst described him as the afterpark where retail investors arrive late on the scene.

Related reading

Instead of waiting for the Golden Cross for green flashFX_PROFESSOR noted the pre-indictment pressure zones as a real value signal. In the case of Bitcoin prices action in recent months, the analyst has underlined the $ 74,394 and the region of $ 79,000 as an accumulation and early positioning zone, long before the Golden Cross became visible. As such, when the cross appeared recently, the action of Bitcoin prices had already been considerably increasing.

The golden cross is often used by traders as a signal to enter a long position, as it suggests that the price of the asset should continue to climb. However, this analysis follows a trend among experienced traders who consider the golden cross as a confirmation more late than a trigger for a rally.

The input zones and the early structure count more, says the analyst

According to FX_PROFESSOR, indicators such as EMAS or SMAS can be useful, but should never come before understanding the price structure, trend lines and real -time pressure areas. He shared an instantaneous of his own Bitcoin price board which combines personalized EMA with a signature parallelogram method to detect where price voltage begins to build. Visible on the graph are entries that form as of April when Bitcoin Abundance of support around $ 74,000Long before confirmation of the crossing.

Related reading

Now, with the bitcoin that grows To the next target area Almost $ 113,000, the analyst’s strategy continues to validate in real time. Nevertheless, confirmation of a golden cross is always optimistic for the action of bitcoin prices, even if the price rally is already halfway at its peak level.

At the time of writing this document, Bitcoin is negotiated at $ 110,734. This marks a slight withdrawal of the new summit of $ 111,544, which was recorded only three hours ago. The price of bitcoin is still up 3.1% in the last 24 hours, and new heights of all time are possible before the weekly fence.

Getty Images star image, tradingView.com graphic